*NOTE: THIS IS NOT THE FINAL STRUCTURE, atleast not for the desktop, as this is my own design, however, the mobile should reflect how it could look on the NAGA site.

As AI stocks surge, talk of an ‘AI bubble’ is spreading, often compared to the dot-com era. But is the fear justified? Today, NAGA cuts through the hype and explains what’s really happening.

We have spent considerable time analysing both eras at NAGA. Our goal is simple: help you understand what is actually happening. More importantly, we want to show you how to position yourself smartly. Because market transitions, while uncertain, often create the biggest opportunities for those who prepare.

What Is the AI Bubble Everyone Keeps Talking About?

The term “AI bubble” refers to concerns that artificial intelligence stocks are severely overvalued. Since 2022, massive amounts of capital have flooded into AI-related companies. NVIDIA alone saw its share price climb by insane amounts in five years. In early 2025, 58% of all global venture capital funding went directly to AI startups. That is approximately $73 billion in just one quarter.

This concentration worries many analysts. When a handful of companies drive most market gains, the risks multiply quickly. We have observed this pattern before. The AI bubble conversation intensified after DeepSeek launched in January 2025. That single event wiped $600 billion from NVIDIA’s market cap in one day. Yet prices recovered within days. This volatility defines the current landscape.

The Dot-Com Bubble: A Quick History Lesson

For those unfamiliar, the dot-com bubble was a stock market phenomenon from 1995 to 2000 (some say 2001). Internet companies received enormous valuations despite having no profits. The excitement around the World Wide Web created irrational optimism. Investors poured money into any company with “.com” in its name.

The NASDAQ Composite rose nearly 600% between 1995 and March 2000. Then it collapsed. By October 2002, the index had fallen 78% from its peak. Over $5 trillion in market value vanished. Companies like Pets.com, Webvan, and eToys went bankrupt almost overnight. However, survivors like Amazon and Microsoft eventually became industry giants.

*NOTE: We could put the youtube video link here (the video that used the script I made), which will interlink with this blog, than back to the social media, creating a web that will heavily boost our SEO results.

Warning Signs from the Dot-Com Era

Several red flags preceded the dot-com crash. Understanding these helps us evaluate today’s AI bubble more accurately.

- Most companies had zero revenue and untested business models

- Price-to-earnings ratios reached absurd levels, exceeding 90 on NASDAQ

- Vendor financing created circular references that masked real financial health

- The Federal Reserve was actively raising interest rates

- Over 85% of dot-com startups eventually went bankrupt

These conditions created a fragile market. When confidence broke, everything collapsed together. The 2001 recession followed shortly after.

AI Bubble vs. Dot-Com Bubble: The Core Differences

Here is where things get interesting. The AI bubble has structural differences that matter significantly. During the dot-com era, most leading companies generated no profit whatsoever. Today, major AI players like Microsoft, Alphabet, and Amazon are decades-old firms with established revenue streams.

Capital expenditure also differs dramatically. Amazon anticipates approximately $100 billion in spending for 2025. Microsoft plans around $80 billion. These are balance sheet decisions backed by actual cash flow. They are not speculative ventures funded by hopeful investors. JPMorgan’s December 2025 analysis concluded that the AI sector exhibits genuine structural utility rather than classic bubble characteristics.

Why AI Represents a Multi-Year Wave, Not a Passing Theme

Understanding this distinction matters enormously. Investment themes come and go. Think 3D printing or electric vehicles. They target specific markets with narrower applications. Technology waves, however, transform entire economies. They ripple across every sector and require investment at every layer of infrastructure.

We have witnessed four major technology waves: mainframe computing, the PC revolution, mobile internet, and now artificial intelligence. Each wave built upon the previous one. PC internet enabled broadband connectivity. Broadband enabled true mobile computing with cloud infrastructure. Cloud infrastructure now powers AI development. These waves do not end abruptly. They mature and create foundations for what comes next.

The dot-com crash remains the only compute wave to collapse suddenly. After six years of growth, including two years of 70% returns, it crashed dramatically. However, this was the exception rather than the rule. Other waves evolved gradually. They consolidated, matured, and transitioned into the next phase. AI appears more likely to follow this pattern.

What Happens If a Correction Does Occur?

Let us address concerns directly. Even if AI valuations correct, the outcome differs from 2001. During the dot-com collapse, most companies had zero tangible value. They evaporated entirely. Today’s AI companies have already demonstrated real productivity gains and created functional products. OpenAI serves 400 million weekly users. These are not imaginary metrics.

History suggests corrections clear weaker projects while strengthening survivors. After 2002, Amazon emerged more resilient. Google launched in 2004. The infrastructure built during the mania enabled everything that followed. Similarly, the compute infrastructure, data centers, and talent pipelines being developed now will outlast any market turbulence. McKinsey and other analysts project a productivity supercycle over the next decade, regardless of short-term volatility.

Regulatory oversight also distinguishes this era from the late 1990s. Governments now actively monitor AI development with privacy laws and safety guidelines.

What Smart Investors Did Then and Should Consider Now

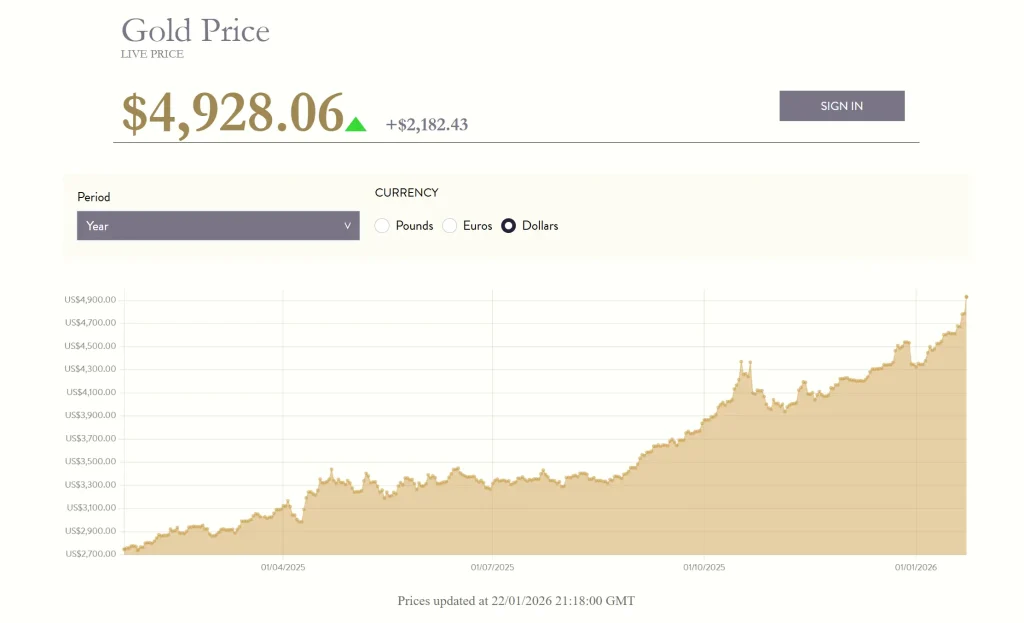

History teaches valuable lessons. During the dot-com crash, investors who maintained diversified portfolios fared significantly better. Those who held only tech stocks often lost everything. The same principle applies today. Market transitions reward preparation rather than prediction. Just since August of 2025 to now, gold has jumped from a market valuation of $3,300 to almost $4,800 today, that’s a jump of 45%!

We have seen this firsthand through our work at NAGA. Experienced traders rarely bet everything on one sector. They balance exposure across asset classes. They monitor volatility indicators. They adjust positions as conditions change. This disciplined approach helped many navigate 2008, 2020, and other turbulent periods successfully.

Defensive Assets and Strategies Worth Exploring

When markets show signs of stress, certain assets historically provide more stability. Gold has emerged as one of the strongest performers in 2025. It has set over 50 all-time highs and gained more than 60% year-to-date. Central banks continue purchasing gold at record levels.

Other considerations include diversified indices, commodities, and established value stocks. Copy trading strategies focused on risk-conscious traders also deserve attention. By observing how experienced market participants position their portfolios, newer investors can learn practical approaches. Of course, past performance never guarantees future results, and all trading involves risk.

How NAGA Helps You Navigate Market Transitions

At NAGA, we built our platform specifically for moments like this. Market uncertainty does not have to mean paralysis. With access to over 4,000 trading instruments, users can explore multiple asset classes from a single account. Real Stocks, CFDs on Commodities, Forex, and more are all available.

Our Autocopy feature connects users with experienced traders whose strategies align with their risk preferences. This creates a social trading environment where knowledge flows freely. Additionally, NAGA Academy provides educational resources, webinars, and market analysis. These tools help traders at all levels make more informed decisions. However, copying another trader’s positions involves risk, and outcomes depend on market conditions.

Important Notice: CFDs are complex instruments with high risk of losing money rapidly due to leverage. Ensure you understand the risks involved before trading.

Final Thoughts on the AI Bubble Debate

The AI bubble conversation will continue for years. Comparisons to the dot-com era are inevitable, given the scale of investment involved. However, dismissing today’s AI boom as simply “another bubble waiting to burst” overlooks critical differences. Real earnings, proven infrastructure, and institutional adoption distinguish this moment.

That said, volatility remains real. Corrections happen, sometimes dramatically. Smart investors acknowledge this reality without abandoning opportunity entirely. They prepare rather than panic. At NAGA, we believe chaos does not destroy opportunities. It creates them for those positioned wisely. Whatever your approach, staying informed and diversified remains essential as markets continue evolving.

IMPORTANT NOTICE: Any news, opinions, research, analyses, prices, or other information contained on this feed are provided as general market commentary and do not constitute investment advice or solicitation for a transaction in any financial instrument or unsolicited financial promotions. All material published on the website is intended for informational purposes only. The market commentary has not been prepared by legal requirements designed to promote the independence of investment research. Therefore, it is not subject to any prohibition on dealing ahead of dissemination. We do not make any warranties about this market commentary’s completeness, reliability, or accuracy. Past performance is not an indication of possible future performance. Any action you take upon the information on this feed is strictly at your own risk, and we will not be liable for any losses and damages in connection with this feed.

FAQ

Q: How likely is the current AI boom to end like the dot-com crash?

Our analysts believe a complete collapse is unlikely, though corrections remain possible. The key difference is profitability. Major AI companies generate substantial revenue and maintain strong balance sheets. JPMorgan and Morgan Stanley both concluded that classic bubble conditions are not present. However, elevated valuations and market concentration create risks. Sharp pullbacks could still occur without representing a full market crash.

Q: How do OpenAI's finances compare to those of dot-com companies from the late 1990s?

OpenAI presents a fascinating case study. The company’s valuation jumped from ~$150 billion in 2024 to $340 billion in early 2025. Yet reports suggest OpenAI may not reach profitability until 2029. This pattern echoes the late 1990s, when companies prioritised growth over earnings. However, OpenAI has secured major partnerships with NVIDIA, AMD, and Oracle for compute resources. Unlike many dot-com failures, OpenAI has tangible technology and 400 million weekly users. The outcome remains uncertain.

Q: Why are AI companies spending so heavily on data center infrastructure?

The computing demands of artificial intelligence are staggering. Training large language models requires thousands of specialised chips working simultaneously. Meta, Amazon, Microsoft, and Alphabet collectively plan over $300 billion in capital expenditure for 2025, primarily for data center expansion. This differs significantly from the dot-com mania, where spending often went toward marketing rather than infrastructure. Real physical assets are being built. However, if AI demand projections prove too optimistic, these data centers could sit underutilised, creating potential shareholder losses.

Q: What changed between 2023 and 2024 that began the talks of AI bubble concerns?

The shift was dramatic. In 2023, NVIDIA’s stock surged 239% as AI excitement exploded. Then 2024 brought another 171% gain. This two-year run concentrated enormous wealth in a handful of AI companies. By late 2024, just five companies held 30% of the S&P 500’s value. You can also note that ChatGPT 4 began to roll out around 2023, which worries many folks which it’s wide knowledge.